student loan debt relief tax credit program for tax year 2021

Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application. Agencies from Education place a beneficial 0 interest rate in these fund and you can paused collection things to your defaulted college loans.

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Or speak to a debt consultant 800-910-0065.

. The Biden Administration has been working to increase student loan forgiveness efforts to erase education debt for hundreds of thousands. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I. Permanent email addresses are required for issuing tax credit awards and for all future correspondence from us.

You Qualify for Federal Student Loan Benefits under the Obama Forgiveness Program. Specifically the bill outlines 31 billion to help distressed borrowers of direct or guaranteed loans administered by the Farm Service Agency and 22 trillion for a program to provide assistance for farmers that experienced discrimination in Department of Agriculture USDA farm lending programs prior to January 2021. CuraDebt is a debt relief company from Hollywood Florida.

The Homestead Tax Credit application deadline is October 1st. The swirling debate over student loan forgiveness. If a new law does cancel 10000 in student debt per borrower in addition to forgiven debt not being taxable the average borrower will save 13400 in interest according to an estimate by taylor.

For unprotected financial debts such as charge card personal finances particular exclusive student loans or other comparable a debt relief program might give you the service you need. The Deadline for the Student Loan Debt Relief Tax Credit is September 15. File 2021 Maryland State Income Taxes.

Permanent email addresses are required for issuing tax credit awards and for all future correspondence from us. Have at least 5000 in outstanding student loan debt upon applying for the tax credit. When setting up your online account do not enter a temporary email address such as a workplace or college email.

Maryland Adjusted Gross Income. Moreover the 20 service charge is lower than many companies that offer an additional 25 charge. One begins to lose rest and really feels pressured.

From the program website. Since he assumed office Bidens student loan forgiveness programs have helped eliminate more than 16 billion in student loan debt. Eligible Applicants are homeowners who have paid their property taxes prior to.

Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt. Heres Everyone Who Wants Biden To Cancel Student Loan Debt Its A Big List. Tax obligation financial debts could be a result of errors from a previous tax obligation preparer under withholding failing to send payroll tax withholdings to the internal revenue service identity theft tax audit or various other factors.

The funds can not be used to purchase the young fund off a keen employees established or mate. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the Student Loan Debt Relief Tax Credit. About the Company Student Loan Debt Relief Tax Credit 2021.

The 20000 limit is for incurred debt current debt must only exceed 5000. When setting up your online account do not enter a temporary email address such as a workplace or college email. Enter the Maryland Adjusted Gross Income reported on your Maryland State Income Tax return form 502 line 16 for the most recent prior tax year.

Ad Apply For Tax Forgiveness and get help through the process. It was established in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators. There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. Under CARES employers could directly contribute 5250 each year tax-free to employees student loans. If you already have.

This employer student loan repayment assistance has been extended through 2025. Student loan debt relief tax credit program for tax year 2021. If you already have.

The Maryland Higher Education Commission MHEC is continuing their Student Loan Debt Relief Tax Credit for 2021. Find Your Path To Student Loan Freedom. August 12 2022 1215 PM 6 min read.

This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Ad Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. From July 1 2021 through September 15 2021.

Having debt concerns is difficult. 1 day agoWhen she started working at NVRDC in 2013 Eliason was able to qualify for DCs loan repayment assistance program which helps pay for the student loans of lawyers at 37 nonprofit employers. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I.

This tax credit is given to help students offset some of their outstanding loan balances and has helped many of them since the program first began in 2017. Have the debt be in their the Taxpayers name. Claim Maryland residency for the 2021 tax year.

Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan debt and provide proof of payment to MHEC. Financial debts can have built up for countless reasons such as an unfavorable hardship overspending separation or other issues. If you already have.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. Eligible applicants are Maryland Tax Payers in 2021 who have incurred at least 20000 in undergradgrad loan debt and still have 5000 outstanding. CuraDebt is a useful program that lets you pay off your debts without spending more for these types of services.

Student Loan Debt Relief Tax Credit for Tax. There is no upfront payment and you will only have to pay the fee when your debt is finally settled. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I.

When setting up your online account do not enter a temporary email address such as a workplace or college email. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Failure to do so will result in recapture of the tax credit back to the State.

Among other things the balance frozen new payment toward the student financial obligation owned by the fresh new YouS. If the student meets these qualifications they can submit an online application by September 15 2021. With the student loan payment pause nearly over here are Bidens remaining options on student debt.

Permanent email addresses are required for issuing tax credit awards and for all future correspondence from us.

Prodigy Finance Review International Student Loans International Student Loans Refinance Student Loans Millennial Personal Finance

Protect Yourself And Your Device Taxes Security In 2021 Tax Refund Saving For College Tax Debt

Student Loan Forgiveness May Come With Tax Bomb Here S What You Should Know

The Government Can Help You With Your Student Loans Find Out How Student Loans Student Loan Repayment Student Loan Debt

Get A Game Plan For Paying Student Loan Debt In 2021

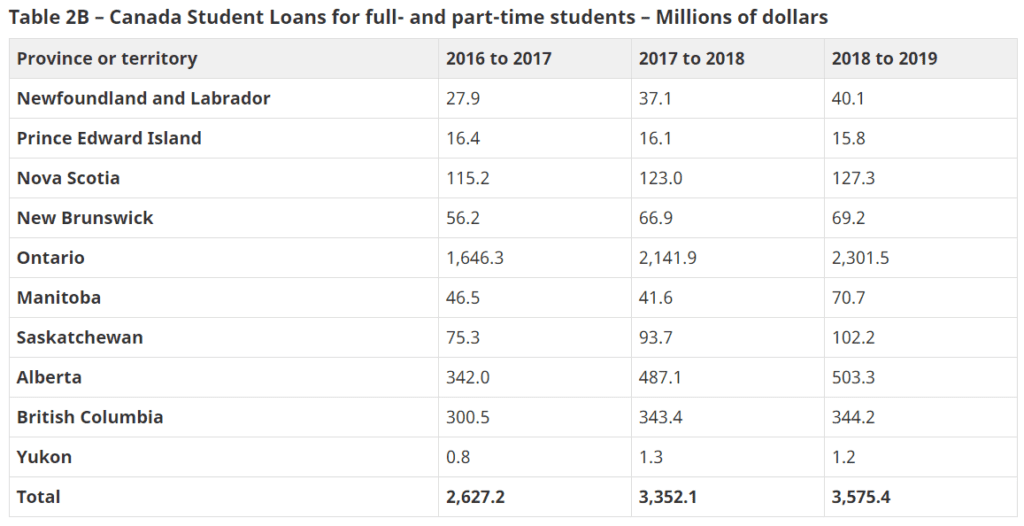

Student Loan Forgiveness In Canada Loans Canada

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Consumer Proposal Student Loans Step By Step Debt Rescue How To Fix Your Student Debt Problems Ira Smithtrustee Receiver Inc Brandon S Blog

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Covid 19 Relief Bill Passes With Tax Free Status For Student Loan Forgiveness

Can I Get A Student Loan Tax Deduction The Turbotax Blog

![]()

Student Loan Forgiveness In Canada Loans Canada

Is There Tax Savings For The Interest On Student Loan Debt Consolidated Credit Ca